Get the free ce 200 printable form

Show details

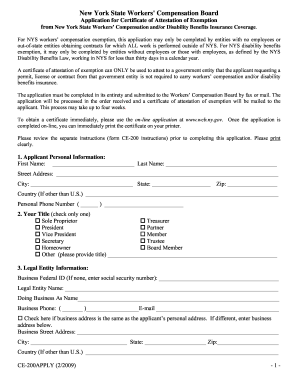

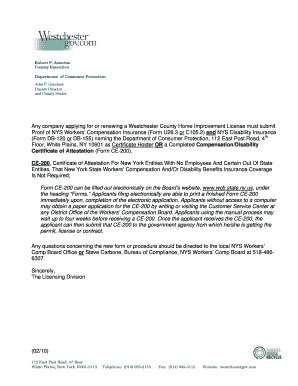

Effective December 20 2011 New York State Workers Compensation CE-200 EXEMPTION FORM is available at www. wcb. ny. gov FOR AN ON-LINE APPLICATION CE-200 12/08 is an on-line application that allows an immediate print of the exemption form. Click on On-Line Services on the right side of the screen. Then click on Request for WC/DB Exemption and follow the directions. Effective December 20 2011 New York State Workers Compensation CE-200 EXEMPTION FORM is available at www. wcb. ny. gov FOR AN...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ce 200 printable form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ce 200 printable form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ce 200 printable form online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ce 200 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out ce 200 printable form

How to fill out ce200:

01

Start by gathering all relevant information, such as personal details, income information, and any supporting documents required.

02

Carefully read the instructions provided with the ce200 form to understand the specific requirements and sections that need to be completed.

03

Begin filling out the form by providing accurate and up-to-date personal information, such as your name, address, and social security number.

04

Proceed to provide detailed information about your income, including wages, tips, self-employment earnings, and any other sources of income.

05

If applicable, include information about any deductions or credits you may be eligible for. This may include expenses related to education, healthcare, or child care.

06

Take your time to review and double-check all the information you have provided to ensure its accuracy and completeness.

07

Once you are satisfied with the accuracy of your entries, sign and date the ce200 form.

08

Make a copy of the completed form for your records before submitting it to the appropriate authority.

Who needs ce200:

01

Individuals who are employed and receive income from various sources, including wages, tips, and self-employment earnings, need to fill out ce200.

02

Those who are eligible for certain deductions and credits, such as educational expenses or healthcare expenses, may also need to fill out ce200 to claim these benefits.

03

Additionally, anyone required to report their income and financial information to the relevant authorities, such as the Internal Revenue Service (IRS) or state tax agencies, may be required to fill out ce200.

Fill ce200 exemption form : Try Risk Free

People Also Ask about ce 200 printable form

Can owners be excluded from workers compensation in NY?

What does AOE mean in workers comp?

Who is required to carry workers comp in NY?

Do members of an LLC need workers comp in NY?

How do I get a workers comp exemption in NY?

What is ce200?

How do I get workers comp?

What does adj mean in workers comp?

What is Workmen's Compensation certificate?

What does CE mean in workers compensation?

Who is exempt from workers comp in New York?

Do you need workers comp for 1099 employees in NY?

What is the abbreviation for workers compensation?

What does Nysif certificate mean?

What does DOS stand for in workers compensation?

How do I become a NYS workers Comp authorized provider?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ce200?

Employers who are required to pay withholding taxes to the California Employment Development Department (EDD) are required to file Form CE-200. This includes employers with employees in California, as well as employers outside California who have employees who are working in California.

How to fill out ce200?

1. Gather the necessary documents. You will need a copy of your current driver's license, Social Security card, and proof of current residency.

2. Log into the California DMV website and select "Driver License/ID Card Application (Form DL 44)."

3. Complete the application. Make sure to answer all questions accurately and completely.

4. Pay the fee. You will need to pay the appropriate fee for the application.

5. Submit the form. Once you have completed the form, print it out and submit it to your local DMV office.

What information must be reported on ce200?

CE200 is an employer’s annual filing of employee wages to the Employment Development Department (EDD). It includes information such as employee name, Social Security number, wages paid, and state wages. It also requires employers to report the total number of employees and the total amount of wages paid during the year.

When is the deadline to file ce200 in 2023?

The deadline to file ce200 in 2023 is April 15, 2024.

What is ce200?

CE200 is a course code typically used to refer to a specific course in an educational institution. The specific meaning of "CE200" would vary depending on the institution and the subject of study. To find its precise definition, you would need to refer to the course catalog or the curriculum of the institution in question.

What is the penalty for the late filing of ce200?

The penalty for the late filing of the CE200 form can vary depending on the jurisdiction and specific regulations in place. In general, late filing penalties can include monetary fines, interest on unpaid taxes, and possible legal consequences. It is essential to refer to the specific guidelines and regulations provided by the relevant tax authority or government body to determine the exact penalty for late filing of the CE200 form.

How do I execute ce 200 printable form online?

Filling out and eSigning ce 200 form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the ce 200 in Gmail?

Create your eSignature using pdfFiller and then eSign your nys form ce 200 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete ce 200 form printable on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form ce 200 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your ce 200 printable form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ce 200 is not the form you're looking for?Search for another form here.

Keywords relevant to ce200 form

Related to ce200

If you believe that this page should be taken down, please follow our DMCA take down process

here

.